showCASE No. 105: Digital Preparedness as a Backbone of the Economic and Social Resilience in the Times of Pandemic

Editorial

In this issue of showCASE, completely redesigned to make reading it a more visually enjoyable experience to our followers, CASE Economist Kateryna Karunska evaluates the level of digital preparedness of households and businesses in the European Union for the times of pandemic, when national lockdowns force private and professional lives online. The impact of the COVID19 crisis on economic growth, labour market, and inflation in Poland and other EU Member States is detangled by our team in the Highlights section. Finally, the last two pages are dedicated to our innovative measure of price dynamics in and growth of the Polish economy.

Alongside the new layout, showCASE gained a new editorial team. As Krzysztof Glowacki - who has been with showCASE from the very beginning and over the past couple of months oversaw its publication - left CASE to pursue an academic career, his place was taken by our in house economist, Kateryna Karunska. We would like to thank Krzysztof for all his hard work and dedication to showCASE and wish him much success on his new path!

CASE Analysis

Digital Preparedness as a Backbone of the Economic and Social Resilience in the Times of Pandemic

The accelerating pace of technological transformation raises concerns about digital preparedness of the economies and societies. Indeed, the advance of new technologies has already reshaped the way people work, learn, and live, and underlined the importance of digital and transversal skills for sustained development and economic growth.

Yet, digital proficiency and technological penetration are far from being equally distributed both spatially and socially, with 17% of households in the European Union (EU) and almost half of the households globally having no access to a personal computer.

The outbreak of the COVID-19 has further exposed the digital divide and disparity of opportunities. Specifically, the pandemic has underlined persistent inequalities not only with regard to digital skills proficiency but also in terms of access to technology and availability of digital devices. As people and businesses are getting used to and begin to grasp the benefits of the digital modes of work and life, a complete return to the previously known digital normal is unlikely to happen. As the post-pandemic reality, therefore, is likely to remain highly digitalised, the availability of comprehensive digital infrastructure and appropriate skills would become crucial for the economic and social resilience and recovery of the EU. On the other hand, without a comprehensive and inclusive digital framework, a swift transition to remote work and online learning induced by the COVID-19 outbreak risks to exacerbate structural inequalities and imbalances throughout different EU regions and within the individual Member States.

European Union Perspective

Following the decrease of the EU GDP by 2.6% y/y in the first quarter of 2020, the Spring 2020 Economic Forecast published by the European Commission on 6th of May estimates that the EU economy will shrink by about 7.5% in the year 2020 due to COVID-19, followed by 6% growth in 2021. While the projected GDP loss is symmetric and negative for all Member States, the scale of contraction and strength of recovery are expected to differ significantly. With the rapid increase by almost 40% in the number of employees practising remote work since the outbreak of the COVID-19, the availability of appropriate digital skills and equipment are likely to become one of the growth-inducing factors.

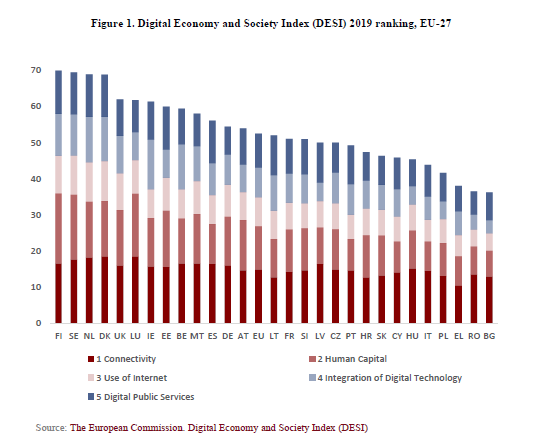

Yet, while the EU is relatively well-positioned in terms of digital infrastructure and skills supply when compared globally, the intra-EU divergences and underlying gaps of the digital transition and integration persist. Indeed, as highlighted by Digital Economy and Society Index (DESI), Eastern and Southern Member States underperform significantly, especially in terms of human capital and digital skills availability (see Figure 1). Specifically, 43% of the labour force in these regions have no basic digital skills, compared to 28% in the Western and Northern European Member States.

As most of the Member States promote social distancing and transition towards remote learning and work, the digital divide throughout the EU is set to grow. This is, inter alia, due to the lack of access to digital devices, which risks excluding the less prosperous regions, communities, and households, including refugees and minorities. This tendency has already been put forward as one of the main challenges in the efforts to ensure continuous and inclusive learning during the pandemic. Thus, according to Jean-Michel Blanquer (French Minister of National Education), in France alone, 5% to 8% of all students have been left behind since the pandemic because of the lack of access to appropriate digital equipment. Indeed, the share of households with no access to a personal computer in Eastern and Southern Europe is twice that in the Western and Northern part of the continent (24% and 12%). The gap is even more apparent when households within different income quartiles are considered – the gap between 4th and 1st quartiles stands at 16pp for the Western Member States, but reaches 46pp and 48pp for the Southern and Eastern Member States, respectively.

Last but least, EU business has been hit hard by the national lockdowns. At the same time, a number of companies, in particular Micro, Small and Medium Enterprises (MSMEs), have benefited from the situation to accelerate their digital transition and diversify operations. A fraction of businesses, however, appeared less resilient and has been unable to swiftly transition to a more flexible and digital mode of work which has already resulted in a drop in production and rise of unemployment.

Poland in a Spotlight

Similarly to the other Member States in the Central and Eastern Europe, Poland faces a number of structural challenges which undermine its digital transition. As showcased by DESI, Poland is among the worst performers in the EU throughout all pillars (see Figure 1). In line with it, a number of studies have identified the lack of digital skills as a major bottleneck to Polish digitalisation[1]. Specifically, about 54% of all citizen and 47% of the Polish labour force have no basic digital skills, while the number of SMEs using social media and online sales is twice below the EU average of about 42% and 28%, respectively. As discussed in the forthcoming report Digital Entrepreneurship for Employability Paths (DEEP) prepared by a consortium led by CASE, this dynamic not only undermines development potential of Polish companies but also leads to the digital exclusion of a fraction of population, mainly those above 45 years old.

As Poland shifted to a national lockdown in early March, the quality of ICT infrastructure and availability of digital equipment became yet another challenge that needs to be addressed in the times of pandemic. Thus, while 18% of Poles have no access to a personal computer and about 10% of households with children have only one computer or tablet to use, there are about 3,700 so-called “white spots” in Poland where households have no internet access, either through fixed or mobile broadband.

As a result of a rapid transition to remote work and distance learning, numerous stories of struggling parents and students unable to attend the online lectures started to circulate the press. According to the Centrum Cyfrowe estimates, up to a million students have to share their devices either with a parent who works remotely or siblings who are also learning online, which limits significantly the time dedicated to and quality of education. At the same time, 36% and 32% of teachers have identified students’ lack of digital devices and internet access as their prime issue to conduct online teaching. From the other end, however, about 30% of teachers are estimated to not have appropriate skills to use digital tools and organise distance learning, while 85% of Polish teachers had no previous experience with distance education prior to COVD-19. The digital divide in Poland, therefore, is set to magnify the inequalities in the times of lockdown and beyond.

The Polish companies also appeared to be not prepared to fully transition to the digital work setting, as only 11.5% of all enterprises have used cloud computing prior to the lockdown. Although these figures have certainly increased since the pandemic broke out, it is likely to remain significantly below the EU average. According to the latest McKinsey estimates closing the digital gap and aligning Polish performance with that of the Western and Northern Member States, could eventually result in about EUR 64 billion gain in GDP for Poland.

Conclusions

While the global efforts are focused on fighting the spread of COVID-19 and limiting the economic loss induced by national lockdowns, digitalisation stands out as an opportunity to mitigate the risks of social exclusion and ensure uninterrupted functioning of the economies. Lack of digital preparedness that has been undermining growth potential of the EU during the normal times, therefore, becomes critical in the times of pandemic as it limits the resilience capacity of business, individuals, and economy as a whole.

One of the pandemic-related benefits, if any, is that it uncovered the magnitude of underlying inequalities and inherent weaknesses of the traditional economic structures which creates a unique opportunity to shape the new normal of work, education, and development. However, one of the major challenges would be to ensure that no one is left behind in this transition to the post-pandemic reality. Addressing many blocking points of digitalisation is one of the crucial steps in this process not only to limit social exclusion but also to ensure the survival and recovery of small and medium-sized business (SMEs) within the EU and beyond.

The developing regions outside the EU are no exception as lack of quality infrastructure, as well as low quality of education and increasing spatial divide limit the capacity of internationalisation and digitalisation of many SMEs. The avenues to address these challenges in the Middle East and North Africa region are discussed in the forthcoming study on the Digitalisation of SMEs in the Mediterranean prepared by CASE in partnership with the European Institute of the Mediterranean (IEMed) for the European Committee of Regions.

[1] See for example Sledziewska, R., and R. Wloch, 2015, Digital Transformation of Small and Medium-sized Enterprises in Central and Eastern European Countries.

Highlights

Trade, Innovation, and Productivity

The European Commission published its Spring 2020 European Economic Forecast on the 06th of May. The EC expects the EU economy to shrink by about 7.4% in 2020, a downturn much sharper than the 4.5% drop in the output due to the 2008 global financial crisis. This is mainly due to a significant decrease in private consumption (by 8.5% y/y) and investment (by 13.2% y/y) figures as a result of national lockdowns and growing uncertainty since the outbreak of COVID-19. Based on the estimates, however, Poland is expected to record the lowest GDP loss in the EU – only 4.3% y/y compared to an average of 6.79% y/y decline in the Western European Member States. The milder expected reaction to the COVID-19 crisis in Poland can be attributed to, inter alia, a relatively low decrease in the domestic demand (4.4% vs 7.2% for the EU-27) and total investment figures (8.4% vs 13.2% for the EU-27), as well as the volumes of exports (9.8% vs 12.8% for the EU-27) as compared to the rest of the EU countries. As far as short-term data is concerned, April 2020 shows a sizeable, 24.6% y/y decrease of industrial output in Poland and a drop in employment in the enterprise sector by 2.1% y/y. The automotive, leather, and furniture industries have been hit particularly hard by the decline of the output by more than 50% y/y, while the pharmaceutical industry stood out as one of the few ones that have experienced an increase in output in April 2020.

Labour, Market and Environment

The impact of the COVID-19 pandemic on the labour market situation is one of the key issues at the moment. According to data from the Ministry of Family, Labour and Social Policy, the registered unemployment rate increased by 0.3 p.p. in April (from 5.4% in March to 5.7% in April 2020). The Central Statistical Office of Poland (GUS) informs that employment in the enterprise sector decreased in April by 2.4% when compared to March 2020, and it was lower by 2.1% than in April 2019. Also, the average wage y/y growth slowed down when compared to previous months. Unfortunately, the above-quoted data do not include micro-enterprises and more detailed picture, based on the GUS quarterly Labour Force Survey (LFS), will be available only in November 2020. To provide up-to-date information labour market changes, University of Warsaw, Group for Research in Applied Economics (GRAPE), and CASE launched the Diagnoza.PLUS project, aimed at collecting labour market information from individuals via web interviews. The survey is designed to provide labour market information comparable to LFS. The first results will be made public the upcoming weeks.

Macro and Fiscal

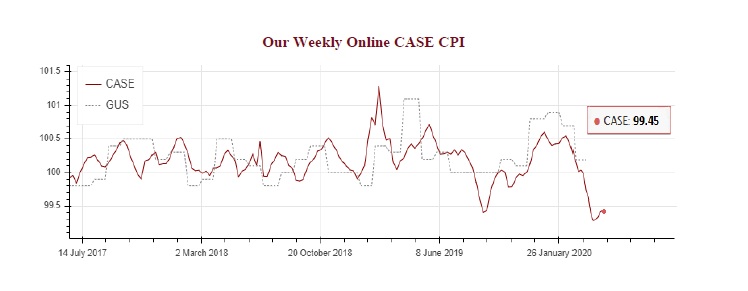

The latest publication of Eurostat shows that Polish inflation is second highest y/y in the EU (2.9%). While high compared to other European countries, the current level of inflation is still significantly lower than it was in February 2020 (4.1%). The price dynamics in Poland have been very volatile in the last couple months – after a period of accelerated inflation which started in November last year, today we see a drop in price levels in m/m frame. According to the Online CASE CPI, mid-May prices fell by about 0.6% compared to last month. The main culprits behind that dissonance are prices of fuel – with the exclusion of “Transportation” category from the price basket, it turns out that the m/m prices were actually higher than a month before (but only slightly). This slowing down effect in the price dynamics will likely work only in the short term, however. The prices of fuel should pick up eventually, and with a high level of core inflation, inflation may return to the February levels.

Other CASE Products

The Weekly Online CASE CPI

The online CASE CPI is an innovative measurement of price dynamics in the Polish economy, which is entirely based on online data. The index is constructed by averaging prices of commodities from the last four weeks and comparing them to average prices of the same commodities from four weeks prior. The index is updated weekly. For more information on our weekly online CASE CPI, please visit: http://case-research.eu/en/online-case-cpi.

The mid-May read-out of the Online CASE CPI shows that the trend of price decrease continues with about 0.6% decline compared to last month. Similarly to April, the main reason for the decline is a significant drop of prices in the “Transport” category (by 5.5% compared to the last month), mainly caused by the global decline in fuel prices. When the “Transport” category is excluded, it appears that the m/m prices have actually increased between April and May. This suggests that when fuel prices eventually pick up we could observe inflation similar to that from January and February.

Monthly CASE Forecast for the Polish Economy

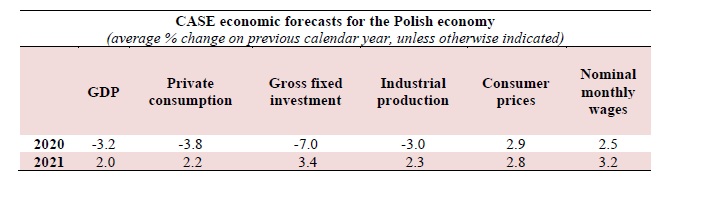

Every month, CASE experts estimate a range of variables for the Polish economy, including future growth, private consumption, investments, industrial production, growth of nominal wages, and the CPI.