showCASE No. 103 I COVID 19 and the Economy – Micro and Macro Perspectives

The developments related to the COVID-19 epidemic have been changing dramatically ever since the situation proved serious in China at the beginning of 2020. At first, it seemed that it was the Chinese production that would be hit the hardest, and, by consequence, affect production processes in the US and Europe. Now, weeks into the pandemic, the world plunged into a combined health and economic crisis, one which has already changed individuals’ and institutions’ ways of working and thinking, and one which has a significant potential to change the manner in which modern economies operate for good.

With the Great Financial Crisis, it was the financial markets that crashed. This time is different, with the currently observed financial meltdown only reflecting that which is feared the most since time immemorial – disease. This time, a V‑shaped revival is unlikely, as the current demand, postponed in time, will not be easily met, and some of the stream of the added value, produced especially by tourism, entertainment, and transportation sectors, will, in fact, be forgone. In Italy, for example, a country hit hard by the lock-down related to COVID-19, first estimations indicate that tourism and transport sectors could shrink by 90%, retail by 50%, and factory output – by 10%. Past global experience regarding the economic consequences of health threats, such as SARS (which, compared to the current COVID-2019 disease, seems to have been less vicious, shorter, and less costly) indicates that the global economy, as well as individual countries, may be in for a long – possibly 12‑18 months long – wait until the sectors mentioned above return to their normal condition.

Even more transmissible, and more devastating for the economy than the virus itself, is fear. Since February, 24, stock prices have been going up and down in sudden bouts of volatility fuelled by uncertainty regarding future events surrounding the coronavirus and the oil market (which initially stumbled due to the disease-unrelated failure of the OPEC+ group to reach an output consensus, as discussed in the section CASE Highlights below). Indeed, with financial markets crashing and panic sales erupting around the world (for example, the Dow Jones Industrial Average going down from 25409.3 points on Feb, 28 to 20178.67 points on March 16), the Volatility Index, or VIX, which gauges investors’ sentiment over the nearest 30 days, soared to levels surpassing those reached during the financial crisis of 2008-2011. Specifically, the VIX hit 77.57 points on March 12, after years of stability (the previous peak of 72.67 points was recorded on November 21, 2008, when first bailout-related doubts surfaced at the time of the Great Financial Crisis). In a more local context, the Polish WIG20 hit rock bottom, going from 1765 points on March 6 to 1595 points five days later, thus breaking the psychological floor of 1600 points.

While much about the new disease remains unknown, it seems that three economic scenarios are imaginable for the next few months: we are in for a quick recovery, a global slowdown, or a global pandemic and a recession.

In the first, most optimistic but least likely scenario, the public health response globally is projected to be as effective as in China, and the virus turns out to be a seasonal phenomenon with the fatality rate close to the one observed in the case of the flu. Additionally, the socioeconomic reaction to the virus remains localised and, while changes in daily habits occur, working populations resume their activities. In this context, the sudden initial drop in demand is offset by a quick rebound initiated by China’s recovery by early Q2. As for Europe and the US, the slowdown may be observed at the end of Q1. Other regions, including the Middle East and the rest of Americas may also experience temporary disruptions in economic activity.

The ‘global slowdown’ scenario upholds the seasonality of the pathogen but assumes that the response of public health services could be less efficient and effective than what was observed in China and that the fatality ratio exceeds that of the common flu. The chief impact is still contained to the US and Europe, where daily routines are shaped by COVID‑19‑related constraints. While China recovers early in Q2, the US and Europe experience the slowdown until mid‑Q2.

Finally, the worst-case scenario assumes that the virus is not seasonal, global public health services turn out to be less efficient than in China, and the mortality ratio is higher – either due to the insufficient response of health services or the pathogen’s characteristics. As the virus proves more vicious than the flu, the case count growth continues until the end of Q3 with the socioeconomic behaviour shifts spreading world-wide. In this case, global economy plunges into a recession, and consumer confidence is dampened roughly until the end of the year 2020.

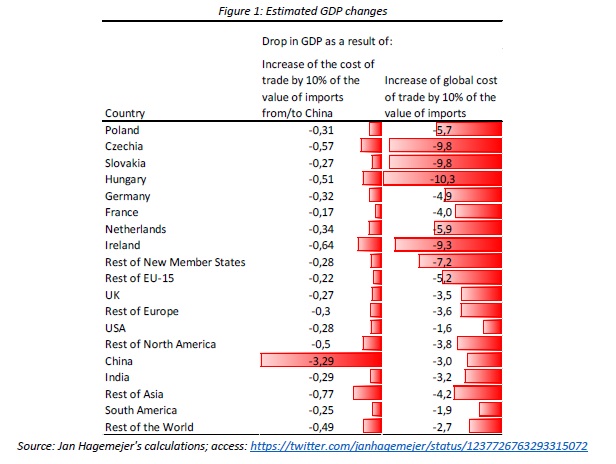

Against this backdrop, Jan Hagemejer of CASE and University of Warsaw shows (Figure 1) that drops in GDP as a result of disruption‑related increases of global costs of trade, assumed to equal 10% of the value of imports, could reach roughly 8.9% in V4 countries (Czechia, Hungary, Poland, and Slovakia), with Poland hit the least (-5.7%) and Hungary – the most (-10.3%). As for major EU economies, France may lose 4%, while Germany slightly more – up to 4.9%. Ireland could be the one to suffer the most, with a slump amounting to 9.3%. These simulations, conducted with a global computable general equilibrium (CGE) model, assume intersectoral mobility of factors of production, so short‑term costs of trade disruptions may be even higher given the constraints in real‑life mobility.

In order to alleviate the situation, governments all around the world have vowed to help businesses restart. At the EU level, the European Commission waived debt limits and state-aid bans, and it also facilitated redirecting medical supplies to countries hit hardest by the disease. The European Central Bank, on its side, urged national governments to assume ambitious, well-coordinated public spending strategies and promised to deliver cheap liquidity for banks to prevent credit market crunches. As for a coordinated, governmental reaction in the face of the viral threat, one may imagine a case-by-case approach to specific companies and liquidity support (one such example may be putting mortgage repayments on hold, as in Italy). Yet, despite such plans of action, it is difficult to judge how much money is going to be enough to cushion businesses and families from the effects of the pandemic. For example, France now declares a EUR 30‑40 billion package covering partial unemployment, taxes, and state guarantees for the loans of small and medium companies (i.e. 1% of the country’s GDP). Still, it appears that a bigger stimulus package, reaching almost EUR 100 billion, may be unavoidable. In the first week of March, the locked‑down Italy claimed that they would need about EUR 7.5 billion to provide its citizens and firms with help, and a week later that sum expanded to EUR 25 billion (more about the fiscal dimension of the aid programs in the section CASE Highlights in a PDF version).

From the perspective of Polish entrepreneurs, things do not look pretty either: almost 39% of small and medium companies (SMEs) believe that the virus will have pronounced negative consequences. Nearly 30% of Polish SMEs voiced concerns that the spread of the epidemic in the oncoming three months will be bad for their business, especially due to lower revenues (57% of respondents) and insufficient labour force (51% of respondents). Rising operational costs and a temporary halt in investment activities appear to be the source of worries for 35% and 30% of SMEs surveyed. However, Polish SMEs come across as financially robust: 26% of the respondents claimed that they would likely survive a year or more, if quarantine procedures kicked in with full force, nearly ¼ of respondents could last up to 6 months, while only 11% said that they would be out of business within 30 days. While banks in Poland agreed to postpone loan repayments for both consumers and businesses, the Polish government began working towards an aid package for entrepreneurs and authorised financial guarantees provided by the Bank Gospodarstwa Krajowego (the national development bank) to small and medium firms. In the meantime, the National Central Bank of Poland carried out, for the first time in five years, an interest rate cut – from 1.5% to 1% – with the aim of providing cheap refinancing for the banking system and stabilising the troubled financial market.

The aid package presented by the Polish government, totalling 10% of the country’s GDP (PLN 212 billion, or EUR 46.3 billion) consists of five pillars: employee safety, firm financing, public health service support, reinforcement of the financial system, and public investment scheme. The instruments include governmental co-financing of wages, postponing of social insurance payments, and micro-loans for entrepreneurs, especially micro enterprises. The governmental solution, however, appears to be less than what entrepreneurs have expected. Following the publication of the project, concerns were voiced that it had not included issues of general interest, for example resolving corporate tax payments or facilitating downtime management and human resources, with the chief question being: Who is going to pay for quarantines and isolation periods? Other stakeholders also indicated that the proposition lacked a plan of operationalisation.

Not only the government but also the private sector has engaged in the tackling of the crisis, with large and small companies and banks across Poland taking action to help provide essential medical equipment and products – for example, PKN Orlen initiated production of antibacterial lotions and ramped up a budget of around EUR 1.3 million to help fight the pathogen. Lotos Group followed suit with ca. EUR 1.1 million to finance the actions, and 4F, a sportswear producer, takes 20% of profits from online purchases made in its 4f.pl store and transfers it to one of Poland’s largest specialised hospitals. Bank Pekao SA as well as the Warsaw Stock Exchange joined these ranks and provided monetary support to hospitals and medical staff.

It is still difficult to judge if the COVID-2019 is here to stay and which of the three major scenarios is the most likely to materialise, and at what cost to the global economy. As the situation is dynamic, any economic projection is short-lived. While it has been said many times over, the final outcome of the current events hinges largely both on the collective behaviour of the society as well as on the coordinated actions taken at the governmental and international levels. Some of the foreseen socioeconomic consequences have already materialised, as did some unexpected ones, too (or example the improvement of air quality in China). The most undesirable ones include severe financial market shocks, unseen since the Great Financial Crisis of 2008-2011, and ever-growing losses counted in billions of dollars, resulting not only from stock market crashes but business stoppages and public spending targeted at health preservation on a scale rarely seen before, if ever.

Written by Anna Malinowska