showCASE No. 113: The 2021 Outlook for the CEE Economies. Will 2021 Really be Better than 2020?

Editorial

The COVID-19 outbreak in the early 2020 has dramatically affected societies and economies all over the globe. It has already claimed two million lives worldwide and lead to an unprecedented contraction of the world’s economies. The successful development of the vaccines in the late 2020 and the expected ease of the containment measures coming ahead give rise to optimistic projections for the economic rebound in 2021.

Against this background, the first edition of showCASE in 2021 provides stocktaking of the key economic changes brought by 2020 to the Central and Eastern European (CEE) economies and Poland, in particular, and discusses the outlook for the year 2021 based on the recent CASE projections.

-----------------------------------------------------------------

CASE Analysis

Written by Mehmet Burak Turgut

As the International Monetary Fund (IMF) projections show, it is expected that the global economy shrunk significantly in 2020 with an estimated 4.4% negative GDP growth rate. The EU economy was not an exception as the economic activity almost halted and the real GDP fell at double-digit rates in the first half of 2020 and it is predicted to close 2020 with 7.4% negative real GDP growth as the recent European Commission forecasts show. The employment has also suffered from a continuous drop in economic activity with the unemployment rate in the EU set to hit 7.7% in 2020 that is one percentage point higher than in 2019.

Central and Eastern European (CEE) Countries

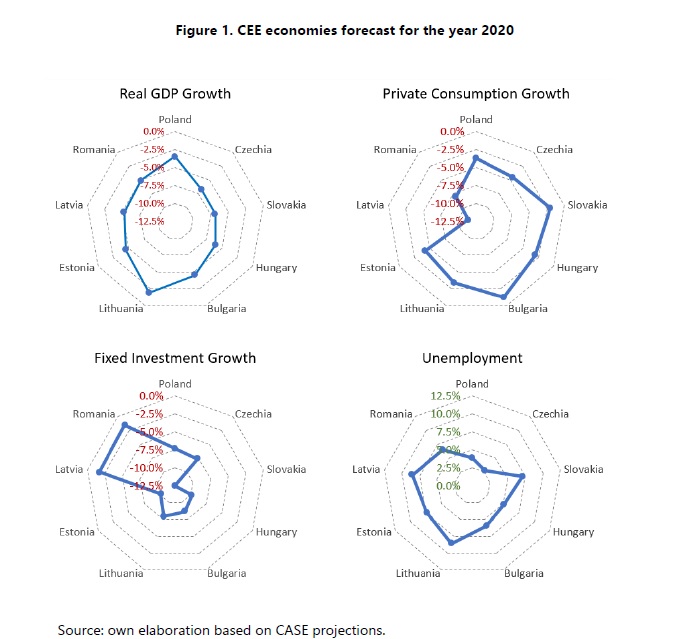

The downturn of economic activity in 2020 is expected to be slightly less pronounced in the CEE countries. The recent CASE projections show that the fall of annual real GDP in any CEE country will not reach the EU average. Czechia and Slovakia will suffer the most from the negative impact of the COVID-19 on the regional economy with an expected 6.8% contraction in GDP. Poland and Lithuania, on the other hand, are the two economies forecasted to decline at a relatively low pace with negative growth rates of 1.9% and 3.5%, respectively.

Sharp decline in the economic activity could also be observed on the labour markets as the unemployment rates are expected to range from 2.7% to 8.6%, the lowest in Czechia and the largest in Latvia and Lithuania. The measures undertaken by the Czech government, the pre-crisis tight labour market, and low share of temporary employment contracts are the main contributing factors to the lowest expected unemployment rates in Czechia.

The governments of CEE countries responded to the COVID-19 pandemic through various fiscal measures such as social security contributions, wage subsidies, increased loans guarantees for medium and large companies, additional loans from micro firms, increased unemployment benefits, interest rate subsidies, and public investment supports. These measures are expected to increase government expenditures by on average 4.8% y/y in 2020. Along with decreased tax revenues, elevated expenditures will likely lead to large gaps in government financing.

Poland in a Spotlight

The year 2020 is set to mark the worst performance of the Polish economy in nearly three decades. In response to the COVID-19 pandemic and restrictions imposed on the economic activity, Polish GDP went down by nearly 9% q/q in the second quarter of 2020 with respective 10.5% and 9% q/q decline in private consumption and fixed investment.

In the third quarter of 2020, with the ease of containment restrictions, the Polish economy sharply rebounded, and the GDP soared by 7.9% q/q. The surge in new infections and reintroduction of containment measures were expected to bring a halt to the recovery of the economy in the last quarter of 2020 with the expected annual real GDP growth at negative 3.5% and unemployment rate at 3.8% for 2020.

The increase in the unemployment rate following the pandemic did not go one-to-one with the decrease in the economic growth thanks to the emergency support measures. The main employment-related measures included subsidies for employee remuneration costs and social security contributions for companies that experienced sharp decline in their turnover.

As of March 2020, the Polish Parliament started adopting legislation packages titled ‘Anti-Crisis Shields’ that, as of January 2021, have already amounted to PLN 312 billion support in a form of credit guarantees, micro loans, and liquidity programs for the businesses. Coupled with the dropdown in economic activity, these measures are expected to significantly deteriorate Polish public finances. CASE projects that the budget balance will reach -9.2% of the GDP in 2020, which could be the largest deficit among the CEE countries. The budget deficit will also push up the public debt in Poland. As a result, the public debt-to-GDP ratio is expected to hit 58.4% in 2020 whereas in 2019 it stood at 45.7%.