Blog

Young people and the labor market: a story of skills mismatch

(23.05.2014) | Bartosz Radzikowski

Ever since 2010, the mismatch in the Polish labor market has become a widely discussed topic. According to the report prepared by the Ministry of Science and Higher Education (MNiSW,2013), in 2011 1.7 mln Poles were enrolled at universities – 420,000 of them were first-years students. At the same time, around 490,000 young, well-educated people with bachelor’s and master’s degrees entered the labor market. Assuming that during the same period of time roughly 100,000 citizens retired and thus permanently left the labor market, and another 100,000 emigrated, the labor surplus was 200,000. Although such a situation may seem favorable for entrepreneurs, they still struggle to find employees with suitable qualifications. Despite the 13 percent unemployment rate (GUS, 2013), employers have been spending more and more time on finding a suitable employee. Moreover, it has been predominantly young people who struggle to find a job, as employers seem especially unwilling to trust them.

Increased mismatch between demand and supply on the labor market is a common problem in most of Europe, for the sake of brevity, I will focus only on the situation in Poland, though.

On the supply side we may observe a lack of convergence between entrepreneurs’ expectations and university curricula. Employers often complain that courses offered do not match market needs, and that too much focus is placed on learning by heart, while real-life skills and abilities are not equally promoted. Although enrollment rates at ever-popular programs such as humanities, social sciences or pedagogy have been on decrease, their alumni will for many years still struggle to find jobs matching their skills. The data from 2001 shows the effects of the so-called ‘ordered courses’, launched by MNiSW in 2008. Currently, more and more people are studying at technical and mathematical faculties, which are much demanded. Their career paths suggest that the ministry’s program may be dubbed a success. Results of the “Human Capital in Poland” study, conducted jointly by the Polish Agency for Enterprise Development and the Jagiellonian University in 2013, show that graduates of the subsidized courses are more likely to find a job.

Another issue is a labor market reform. It is hardly possible to force employers to hire more people. What can be done, though, is employment barriers removal that can be achieved through the adoption of well-targeted reforms.Demand for employees, especially the young ones, is characterized by a high price elasticity, so reduction of tax wedge would have a positive impact on the employment level. Another good idea might be fiscal devaluation, i.e. lowering of the already paid labor cost with a simultaneous boost of income from the value-added tax (which should be achieved not through tax increase, but tax system tightening; the taxes are high as they are). As a result labor costs would decrease, but incomes to the budget would not. The increase in payrolls may also be encouraged by higher flexibility in employment relationships, and deregulation and elimination of the market entry barriers. It has been proven that employment growth is higher when labor market liberalization is accompanied by an increase of the market for products and services competitiveness .

Finally, we need to rethink our attitude towards work in general. Granted, people generally prefer to spend their time with family and friends than at work. Nevertheless, we should not forget how important are the need for personal development and the feeling of satisfaction that being a part of the societal wealth generation process brings. A survey carried out among 8,000 job-seekers (BLK,2013) shows that the main cause of unemployment is a lack of suitable offers and connections that would facilitate a recruitment process. Very few interviewees mentioned the lack of experience or qualifications. While looking for a job people rely mainly on family’s and friends’ help (75 percent), labor offices (67 percent) or direct contact with employer (55 percent). At the other end of the spectrum we have answers provided by 16,000 managers and companies’ owners. According to 54% of them, the most important qualities in prospective employees are those essential for independent work organization (such as self-reliance, time management, decisiveness, initiative, stress resistance and good work attitude). Interpersonal skills are equally vital – 42 percent of employers underline the importance of communicativeness, ability to cooperate well with others, and work under tough conditions. Professional competences were mentioned in the third place (40 percent of respondents). In other words, employers expect they future employees to be first of all independent and passionate, and only then easy-going and well-qualified, which allows for overthrowing a conventional wisdom that entrepreneurs value foremostly experience and education.

Studies show that prolonged unemployment at a young age increases the probability of employment problems in the future. Furthermore, remuneration of those unable to find a job after the graduation is on average 20 percent lower (Morsy, 2012). Morsy coined a term „scarring effects” – the ‘scars’ are left after lost opportunities in terms of acquiring both experience and ability to operate in a work environment.

Implications of long-term unemployment at a young age are particularly severe. I believe the problem might be solved by fighting skills mismatch, economic reforms, and encouraging young people to more actively fight for their place on the job market. It is after all them who have to most power to change their lives and to avoid the “scarring effects”. The consequences of their lost opportunities are borne not only by them, though, but by the entire society.

Bibliography"

BKL (2013), Polska Agencja Rozwoju Przedsiębiorczości, Badania Kapitału Ludzkiego w Polsce.

Morsy H. (2012), “Scarred generation”, IMF Finance and Development, 49(1), 2012.

GUS (2013), Biuletyn Statystyczny nr 3/2014.

GUS (2011a), Szkoły wyższe i ich finanse w 2011 r.

GUS (2011b), Emerytury i renty w 2011 r.

GUS (2007), Przejście z pracy na emeryturę.

MNiSW (2013), Szkolnictwo wyższe w Polsce.

*The views and opinions expressed here reflect the author(s) point of view and are not necessarily shared by CASENetwork.

You can see the original text (in Polish) here.

Active aging - a privilege or an obligation?

(27.03.2014) | Lucie Vidovićová

***This piece was originally published on Forbes.pl

Active ageing has been one of the most important mantras of the last few decades. You can hear the call for activity in advanced ages from academics, colourful women’s magazines and politicians alike. European populations are ageing, the share and number of older people is rising with the expected peak to be around the year 2060, and if we consider older age to be a burden, we may understand the panic from the demography which has been raised by different actors.

Active ageing comes to the rescue as a “win-win” solution: let’s proclaim the ageing as a resource, let´s be active and let´s contribute with no age limits imposed. Well, even if I regard this idea and the connected policy quite reasonable, there are many „buts” that come to mind. First, the recent economic crises showed that the bright future may be much less dependent on the demography than we originally thought. Yes, we want more people in the labour market, but do we have jobs for them; yes, we want balanced fiscal policies, but how do we actually build our priorities; yes, older workers are an important part of the overall employment, but there is more to life than just work.

According to recent census data in my country, the Czech Republic, there is about 10,4 million people out of which only 4,6 million are employed, the rest are children, unemployed, women on maternity leave, old age and other pensioners and others who are economically inactive. This 44% of the total population is producing enough to rank the Czech Republic 36th in GPD per capita in the world. This ratio is not usually mentioned when we hear of the doom which is about to fall on us in the form of old age dependency ratios. Old-age pensioners represent only about one third of the economically inactive population, yet they still seem to be on the very front line of „activization“. And we may go on to open Pandora’s box of questions on the issues of productivity, employability, skill-mismatch and other key concepts which have, so far, hardly ever been connected to the active ageing agenda.

Secondly, I would argue that older people - active ageing subjects - do not exist, at least not as a group. This label we continuously using covers at least 35-40 years of life. We would not dare to place a newborn and Carmen Electra, the oldest model ever to be on the cover of FHM magazine, into the same policy group, yet we do it with seniors on regular basis. In line with this argument, I would also argue that there is very little recognition under the active ageing agenda of internal heterogeneity of this older people “group”. Besides the obvious, such as gender, education, income, social class, etc., there are also preferences. In one of my surveys I have shown that there are at least three groups of older people when it comes to the preferences of latter age activities: those retirement oriented, those work oriented and the adaptive group. They are ideal groups, but the data shows that the work oriented tend to continue to work regardless of any retirement policies and those who are retirement oriented retire, often as early as possible, regardless of any active labour market policies. Those two types even react to the same policies and measures, such as the „need to learn new IT skills“, in quite opposite ways: for one the is reason to stay longer in the labour market, for others it means to flee from it at even higher speed. Only the adaptives tend to be responsive to policies and life circumstances, being somehow more flexible in regards to their value –based preferences.

Thirdly, as already mentioned, there is more to life than just work. There is partnership, parenthood, grandparenthood, leisure, education, physical wellbeing, care obligations, hobbies, volunteering, disagreements, yoga classes, widowhood, environmental press, un/employment of children, divorce, cruise trips in the Mediterranean.... and many others issues which occupy the lives of 50 to 70 years olds in Western societies. All combined, they may produce what is called a role overload”, a concept which has been disregarded by the normativity of „the best way to age is actively“ approach.

Not everybody had, has, or will have the same capabilities or possibilities, the same preferences or capacities, or even the aptitude to work longer and age actively. And that should be ok. We may not need or even be able to accommodate every ageing person in the labour market, but what we need to do is to support those who want to work and lower the numbers of those who need to because of financial stress. We also must respect those who want to just relax and enjoy their later years, whatever they may bring.

We encourgae you to see the latest publication prepared by Lucie Vidovićová withing MOPACT project - "Active Ageing Policies in Employment in the Czech Republic". The publication can be downloaded here.

*The views and opinions expressed here reflect the author(s) point of view and are not necessarily shared by CASENetwork.

Time for changes in the Polish tax system

(26.02.2014 | Grzegorz Poniatowski)

***This piece was originally published on Forbes.pl

People living in first floor apartments may finally breathe a sigh of relief. A couple of days ago the Ministry of Finance issued a statement saying that those who live on the first floor and therefore are not obliged to pay a fee for the use of the lift will not be eligible for any voluntary benefit from the housing association (http://www.mf.gov.pl). Although this bizarre situation, which strikingly resembles a Gombrowicz novel, was swiftly sorted out, it received a great deal of media attention which presented it as yet another symptom of a broader problem – an unwielding Polish Tax Code. As many commentators pointed out, it is not a matter of minor importance. If Poland really wants to get on the path of economic growth, an overhaul is needed. Fortunately, the minister of finance Mateusz Szczurek seems to be aware of that – while taking office, he promised profound tax system changes to be conducted in 2 years’ time.

What should be changed in the Polish tax system?

A lot but not everything.

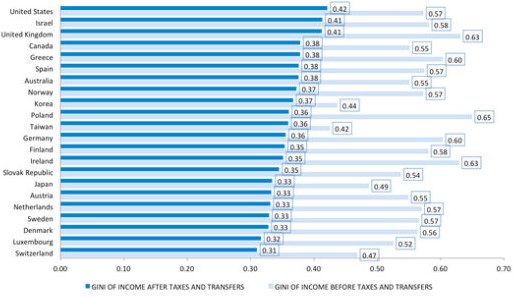

All the criticism aside, there is one thing that the Polish tax system does quite successfully – it reduces income inequalities. As a result of research carried out with use of the GINI index, the typical yardstick of inequality, plenty of liberals came to the conclusion that this mechanism properly serves its purpose. According to the study prepared by Janet Gornick from New Yorker (all data comes from 2011), Poland ranks 5th among developed countries and is somewhere between the socialistic Switzerland and the liberal United States. With taxation excluded from the calculations, Poland comes first, but unfortunately it leads the group with the highest inequalities.

Disparities in income redistribution in 2011

Source: Janet Gornick, New Yorker

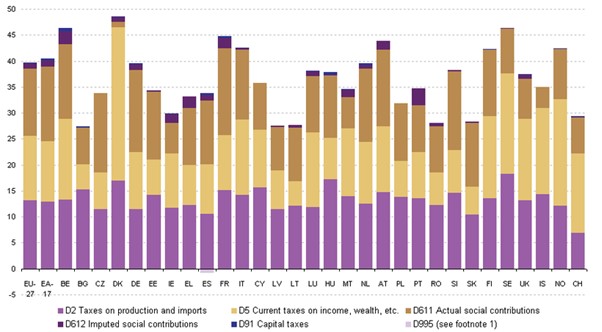

In our country, a share of the labour taxation in a tax wedge is relatively low. Especially when compared to those prevailing in other European Union states, the Polish system does not look bad at all. Given the fact that labour taxation affects employment in the worst possible way, 3 percentage points that stem from a charging income with 33 percent tax wedge should not be threatening. After all, quite a significant part of our salary goes to the Zakład Ubezpieczeń Społecznych every month. As the following chart shows, Personal Income Tax is a rather irrelevant part of the total tax wedge.

EU tax wedge in 2012

Source: Eurostat

If we use the Eurostat data, we would be able to better understand a tax wedge structure as well as to see its total value. While comparing it to those of the EU countries, being at a similar level of development, we may also notice that smaller fiscality is not only possible but also highly desirable. How then to reduce a tax burden? Actually, a solution is pretty simple – we just have to eliminate tax loopholes. It is a well-known fact that an overextended shadow economy considerably reduces government income. Unfortunately, Poland is an inglorious leader in this area - about 15-25 percent of real tax liabilities, depending on the research method, is not being registered.

As many international reports show, a significant size of the informal market is not the only weakness of the Polish tax system. According to the Global Competitiveness Report, issued annually by the World Economic Forum in Davos, about 34 percent of respondents point to unclear regulations and high tax ratios as factors that are particularly inhibiting business operations. Sustainable Governance Indicators, OECD research conducted among 32 countries in 2011, confirms these findings. Furthermore by the European Tax Survey. The benefits of stability, a study prepared by Deloitte in 2013, proves that our system is the least stable in Europe. There are simply too many regulations which are constantly being changed.

All things considered, current operating solutions are too complicated for taxpayers. They should be constructed in such a way that no alternative interpretations, similar to the “lift case”, are needed. It is vital to understand that the Polish economy will be able to develop only as long as tax law becomes clear, the tax system stabilizes and shadow economy and fiscalism decidedly reduced.

You can see the original text (in Polish) here.

*The views and opinions expressed here reflect the author(s) point of view and are not necessarily shared by CASENetwork.

Polish government takes the right decision – nuclear power program approved (guest entry)

(20.02.2014 | Prof. Andrzej Strupczewski, PhD, National Centre for Nuclear Research)

When two years ago Greenpeace published the report „Sea wind against atom” the authors claimed that off-shore wind farms are the least expensive way to develop the Polish power system. They did not expect that life would bring the answer so soon in their dispute against the author of this text. This answer means a disastrous failure for the wind power lobby and the failure brought by the actual implementation of their proposals in the largest economy in the European Union – Germany.

Germany has started a program of power transformation called Energiewende, which had been developed for political reasons, but had neither economic nor technical justifications. When the program was proposed, the German society received promises of cheap energy from the Sun and wind, world leadership in technology and new jobs. Today we can see the effects of this program.

Here are a few facts:

The cost of electric energy delivered from off-shore wind turbines to the German power network has been set as 190 euro/MWh, while in neighboring France, the nuclear power plants deliver electricity at the price of 42 euro/MWh. The expected cost for future nuclear units with the latest III generation reactors EPR is 75 euro/MWh, and according to the French even less (55 to 60 euro/MWh).

Nuclear power works without subsidies. What is more, it brings to France 3 billion euro per year due to the expert of the cheapest electricity in EU. On the other hand, in Germany the subventions to renewables have been growing every year and in 2013 exceeded 20 billion euro per year. In 2014 it is expected to be 21 billion euro. The Germans pay 0,29 euro/kWh for electricity, which is twice higher than in France - 0,13 euro/kWh. In Denmark – another leader in wind power – the electricity price to individual users is even higher - 0,3 euro/kWh. Meanwhile, the average price for individual users in the EU countries is 0,2 euro/kWh.

In rich Germany over 300 000 families per year cannot pay their electricity bills and their electricity supply is switched off. The German industry is losing its competitive edge and many companies declare that they will move their facilities to other countries with lower electricity prices.

Even the vice-chancellor of Germany, Mr. Sigmar Gabriel, declared in January 2014 that the support of renewables has reached "the ceiling of economic capacity of Germany”. At the same time, the emissions of CO2 – which should have been reduced by the introduction of renewable energy – have increased!

Due to instability and unaccountable character of wind power, many industrial enterprises which require constant and reliable power supply have undertaken construction on their own mini-power plants with diesel generators. This is a solution to power supply problems frequently seen in developing countries, but unheard of so far in the centre of Europe. German industries are protesting and threatening to relocate to other countries.

What is more, the subsidies, which were to bring technological advantages and new jobs to Germany, have not resulted in profits to the investors or to the workers. The leading German companies which produce photovoltaic panels have lost 21 billion euro, many of them have declared bankruptcy and large power companies have closed down their renewable power departments with hundreds of workers becoming unemployed. According to the data published by the German Statistical Office in January 2014, the number of people directly employed in the photovoltaic industry has been halved over the last two years.

The European Union still declares that reductions of CO2 emissions are needed. However, the European Commission realizes how economies are losing due to forced development of renewable power, leading to high electricity prices. During the last few years the EU industry lost 8 million jobs. The EU Commissary for Economy Gunther Oettinger criticized putting climatic policy above the economy and the Commission has proposed, as one of the objectives for 2020, to increase industrial contribution of the GNP from 15% up to 20%. However, to reach this target it is necessary to have cheap energy.

The Polish political elite also share the conviction that inexpensive energy is necessary as seen in the presentation of deputy prime minister Piechociński of February 2014 r. .

Although the opponents of nuclear power have always claimed that nuclear power plants are too expensive, today these NPPs provide cheap energy to all countries. And they are the same NPPs which have been criticized as being too expensive! The nuclear power plants that will be built in Poland will also provide cheap electricity for 60 years. And cheap electricity, with clean air, clean water and clean soil is the basis of a prosperous economy and the health of the inhabitants.

The decision of the Polish government to approve the program of nuclear power for Poland is the only logical answer to the necessity of building low emission energy sources which produce electricity at stable and low price. Nuclear power plants are the only reliable source generating large quantities of electricity while keeping our air, water and soil clean. Moreover, the NPPs with the III generation reactors which are to be built in Poland will assure the full safety of the population. It is not the task of nuclear power to replace all other energy sources in Poland. The coal fired power plants will be still needed. However, nuclear power is necessary to bring our electricity production per capita up to the average level in the EU. They will also allow to keep some coal resources for the future, so that we shall have safe sources of electricity for us and for our children.

You can see the original text (in Polish) here.

*The views and opinions expressed here reflect the author(s) point of view and are not necessarily shared by CASENetwork.

Will supporting young entrepreneurs save the Polish labor market?

(12.02.2014 | Anna Ruzik-Sierdzińska)

The difficulties faced by young people in the current labour market have been constantly present in the media and discussed by economists and politicians alike. It has also become an important area of research – a large part of the EU 2014-2020 research funding is devoted to various aspects of the activity of young people. As far as the labour market goes, they constitute a group who have been hit particularly hard by the crisis. In European countries, the youth unemployment rate is at least twice the national average, and in some regions it exceeds 50%. It is getting more and more difficult to find a first job after. Younger generations may be better educated than the previous ones, however education does not seem to protect against unemployment during recession. Young people are more likely to be employed on fixed-term contracts or in various flexible ways, many levels below their qualifications.

According to Polish Labor Force Survey, in the third quarter of 2013 the unemployment rate in Poland amounted to 9.8%. For people below 24 it was 26.7%, for 25-34 age group – 10.4%, for those between 35 and 44 – 7.5%, and for people 45+ it was 7.1%. The unemployment rate among graduates, people aged 15-30 who have completed their education within the past 12 months and do not study anymore, is a staggering 33.8%. That means it has increased by two percentage points since the third quarter 2012. The unemployment rate among university graduates (23.8%) is relatively low when compared to the less educated people (45%). What should be done then to speed up the process of finding a job after graduation and preventing a rapid depreciation of human capital?

One of the ideas on how to activate recent graduates is to encourage them to start their own businesses. Entrepreneurship development is certainly important. The economies of countries where the conditions for doing business are favorable, grow faster. The Ministry of Labor and Social Policy has been recently promoting the program "First Business – Startup Support", which was established last year. Within the program, recent university graduates (who completed their education during the previous 48 months) and not employed final year students are offered preferential low-interest loans to start their own businesses. Individuals who submit a loan application, including a business plan, can get up to sixty thousand PLN and can apply for an additional twenty thousand should they hire an employee. The main incentives are the low interest rates – only 0.25 percent of the Polish National Bank (NBP) rediscount rate – and a relatively long repayment period (up to 7 years) with an option of a one year grace period.

The program has its merits but is not free of disadvantages. The undeniable advantages are the easier access to cheap capital for potential entrepreneurs, as well as protection for some young people from unemployment or economic inactivity. Moreover, the fact that the offer is directed towards people with higher education may increase the chances of the start-ups being successful, if we assume that with higher education comes better ability to find the information needed to run your own businesss. Starting a business may be regarded as an opportunity for a more interesting job and faster professional development, as well as an alternative to the lack of employment opportunities available elsewhere.

Nonetheless, several risks need to be taken into account.

First of all, it is possible that some companies would have been created even without publicly-funded loan subsidies. There is therefore a risk of a deadweight effect, with only part of the employment growth being a result of the program.

Second, the success or failure of a startup depends on several factors, one of them being the prospective entrepreneurs’ personality and abilities: whether or not they are good at time management, are good leaders and managers, and will have enough energy to deal with both the day-to-day business activities and administrative issues. Owning a business carries considerable risk. According to GUS (Central Statistical Office), half of the companies cease to exist within 5 years after forming. One of the requirements to obtain a loan is the preparation of a good business plan, an ability which many students, especially those without a background in economics, lack (to be fair, even those who did graduate in economics often do not possess this kind of knowledge). Consequently, there is a need for support for potential entrepreneurs in terms of the search for information and the preparation of economic development forecasts and analyses, especially those related to the industry in which they wish to operate. Finally, the funds currently available are able to provide approximately 300 loans; therefore the program will not have a huge impact on the job market on a national, or even regional, level.

Summing up, the program promoting entrepreneurship among young people has some potential, but it requires regular monitoring of new businesses, including the number of additionally employed people. More difficult, but certainly worthwhile, would be to examine whether the people whose applications for loans were rejected managed to find alternative resources to start a business and to compare their status on the labor market with the performance of those who did receive the loans.

What definitely should not be expected is that the program will have a huge impact on the labor market. The development of micro-enterprises should be stimulated not only by facilitating access to capital for small groups of potential entrepreneurs, but mainly by the removal of impediments such as: exceedingly high taxes on wages and non-wage labor costs, administrative barriers, competition created by companies operating in the informal economy, insufficient protection of intellectual property, etc.

You can see the original text (in Polish) here.

*The views and opinions expressed here reflect the author(s) point of view and are not necessarily shared by CASENetwork.

Sweet poisons and bitter medicines

(05.02.2014 | Maciej Sobolewski)

The latest amendments to the law on open pension funds (OFE), i.e. secon pillar, are yet another example of Poland’s systemic inability to introduce major long-term reform programs and are a clear indication of poor economic policy.

Populist arguments against pension funds aside, it is difficult to see in the arguments of the supporters of the proposed changes anything but a desire for an instantaneous solution to the public finance crisis. The importance of such immediate benefits was evident not only from the sheer speed with which the law allowing the transfer of around 150 billion PLN from pension funds to the Social Security Fund was passed, but also from the fact that it does not contain any mechanisms that would oblige the government to carry out broad, structural public finance reform in the nearest future. That said, it is beyond a doubt that a reform is necessary. However, introducing changes in the pension funds alone will only temporarily solve the public finance crisis. If the structural problems of deficit accumulation remain unaddressed, the crisis will return in a few years.

The changes in the law on pension funds bring mainly short-term benefits. Their negative effects, i.e. a reduction in the economically-stabilizing level of savings and a lasting decline in private sector investment via the stock exchange, will be felt in the long run. Opponents of the amendments argue that the structural public finance problems could have been successfully resolved over the past years, if only there had been enough political will. Moreover, even in light of a recent exacerbation of the situation, in their view different remedial procedures could have been undertaken.

As soon as the second pillar of the pension system was introduced, it became clear that it would be costly for the public finance system and would require budgetary discipline. The reform introduced by the AWS (Solidarity Electoral Action) – UW (Freedom Union) coalition was therefore not only a step towards the modernization of the pension system, but most importantly a great commitment on the part of the political elite to rationalize public finances. Due to the nature of the pension system, this commitment extended beyond a single political term. At the core of this reform was the assumption that all future governments would be less prone to interest group pressures and, thus, would spend public money more responsibly. In this sense, the AWS-UW government's pension reform was quite remarkable, as it was a rare example of a willingness to self-restrain its power. It is a shame that the obligations arising from this reform were not taken seriously by subsequent governments.

For all these reasons, the recent amendments to the law on pension funds will also have much more serious consequences than it might seem on the surface. Even if the government is correct in claiming that there was no alternative solution for avoiding excessive deficit in the current situation and that the cost of the originally-designed pension funds is unsustainable for current and all future public budgets, it is a great failure of both the present and previous governments. The latter have all contributed heavily to the current situation by putting off unpopular decisions, which could have restored the balance in the public finances, in favor of immediate political gains. The conclusion is that dismantling the essential elements of the 15-year-old pension reform, whether necessary or not, undermines future retirees’ confidence in both state institutions and the entire political elite. And this is one of the major costs of the recently-approved changes.

The pension fund case clearly shows the degree to which Polish politicians fail to take into account the future beyond their term in office when planning major reforms, thus unfavorably distinguishing Poland from the highly-developed Western countries. To paraphrase the apt metaphor coined by German philosopher Max Scheler, responsible economic policy needs consistency in making the right choices between bitter medicines and sweet poisons. By deciding to take over the pension fund contributions rather than carry out the extensive public finance restructuring that has been put off for years, the government has once again chosen the sweet poison instead of the bitter medicine.

You can see the original text (in Polish) here.

*The views and opinions expressed here reflect the author(s) point of view and are not necessarily shared by CASENetwork.

Eliminating civil law contracts: What has not been said?

(22.01.2014 | Izabela Styczyńska)

The proposed elimination of civil law contracts in Poland has been widely and heavily commented. Some experts talk about growing bureaucracy and its adverse implications for the economy. Others emphasize an alleged increase in job security, wages and even human dignity, while yet others focus the discussion on the effects on the labor market, employment, and – possibly – unemployment. However, hardly anyone has thus far mentioned the ways in which such a move would limit personal freedoms: not only the freedom to work here and now, but also the freedom to choose how to save for retirement, and the freedom of employers to hire people in a cost-effective and convenient way.

Let’s try, then, to briefly discuss how this seemingly modest change in legislation, which is supposedly designed to enhance human dignity and security, would in fact limit the freedom of action of various economic actors. According to Balcerowicz (2012), freedom of labor may be defined as “freedom to choose one’s occupation, to seek employment and to negotiate the terms of the employment contract.” The proposed change would introduce restrictions on both employers and employees and, as a result, limit this freedom. A student who wants to earn some extra money during weekends and does not yet feel the need to save for retirement, i.e. to pay social security contributions, would be forced to do so if the new law passes. Why should this be the case? Why should artists enjoying the flexibility of their freelance contracts be made to register their own companies and become entrepreneurs? The new law proposed by the Polish Government would undeniably mean a violation of the average Pole’s freedom of labor.

The second and equally important issue is that the elimination of civil law contracts would pressure people into saving for their retirement through public institutions. The role of the government is to encourage people to save for old age, but how and where they do it is a private matter. Should an increasingly larger portion of our earnings be earmarked for the public social security institution (ZUS)? Economic theory clearly states that risky investment decisions should rely on diversification. Does the state educate citizens about these principles, though? Are people aware of them? Or are they being deluded by the idea of the solely-legitimate state-run social security system? Gwiazdowski (2012) lists many forms of saving: investing in oneself, starting a business, purchasing insurance, making bank deposits, investing funds, purchasing real estate and/or commodities, and so on. However, someone needs to educate and inform citizens about these possibilities. Even if the government would allow people to save for their retirement by themselves, how would they manage to do so if they do not earn enough? According to recent data, the mode wage in Poland is roughly PLN 2,000, and the employment rate has not increased, despite a slight drop in unemployment (CSO, 2013). Surely the government is aware of these data, so how can it – as a rational actor – oblige people to give away more money to the state?

Supporters of the proposed change claim that it would cause an increase in wages. Apparently, this would be due to the fact that employers alone would bear the cost of additional taxation. One of the ensuing consequences would be an increase in the cost of labor. We therefore need to ask ourselves whether employers will still consider it profitable to hire people. Alas, it is not very difficult to find the answer. All statistics indicate that labor productivity in Poland is one of the lowest in Europe, as is state investment in innovation and modernization. Our economic policy is, unfortunately, focused on relatively labor-intensive industries whose competitiveness stems from low wages. The government now seeks to impose yet another economically-ineffective burden on employers and employees, while it should instead be focusing on creating long-term incentives for entrepreneurship, cutting red tape (which is detrimental to private sector development), and generally altering the business environment so as to enable companies to increase productivity and, subsequently, wages.

It is impossible to talk about the removal of civil law contracts without acknowledging the ways in which it will limit citizens’ freedom. It should be impossible to force people to give away more and more money to the state without educating them about the only rational way to save for their retirement, i.e. through diversification. Finally, it is implausible to accuse employers of treating their employees unfairly, while doing very little to improve the business environment. Eliminating civil law contracts is not and will not be proof of concern for human welfare. Instead, it is quite clearly an attempt to limit citizens’ freedoms, as well as another way to impose taxes designed to fill the gap in the public social security budget. Whether it will work remains to be seen.

***

Balcerowicz, L., 2012, Odkrywając wolność. Przeciw zniewoleniu umysłów. Antologia (Exploring freedom. Against the enslavement of minds. Anthology) Wydawnictwo Zysk i S-ka.

Gwiazdowski, R., 2012, Emerytalna katastrofa i jak się chronić przed jej skutkami (The pension disaster and how to protect againt it). Wydawnictwo Zysk i Ska.

You can see the original text (in Polish) here.

*The views and opinions expressed here reflect the author(s) point of view and are not necessarily shared by CASENetwork

See also:

Millions of Poles employed on "junk" job contracts await reforms promised by the government (in Polish)

(14.01.2013) | TVP Regionalna

Eliminating "junk" job contracts will help neither contractors nor the economy (in Polish)

(13.01.2014) | NEWSERIA